tax reduction strategies for high income earners australia

50 Best Ways to Reduce Taxes for High Income Earners. Connect With a Fidelity Advisor Today.

How Do Taxes Affect Income Inequality Tax Policy Center

A tax offset of 10000 would reduce your tax payable down to.

. Connect With a Fidelity Advisor Today. The first way you can reduce your taxable. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Most of our Sydney clients are in the top 15 of earners in Australia. Specifically important numbers for 2022 include. This is also called salary packaging and it works a few different ways.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Most of our sydney clients are in the top 15 of earners in. In many cases the tax savings can be tens.

Most of our sydney clients are in the top 15 of earners in australia. For those trying to learn how to save tax in Australia salary sacrificing is one way to do it. August 12 2014.

Consider salary sacrificing to reduce. In all honesty taking advantage of a donor-advised fund is probably one of the best strategies to reduce taxes for high income earners because it allows you to take current. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Many Australian Tax Videos Are Discuss The Same BORING Strategies. Prepay tax-deductible expenses to bring your tax deduction forward. Tax code is structured so that high earners pay a higher tax rate the ultra-wealthy often take advantage of laws that enable them to lower their effective tax rate.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

How Do High Income Earners Reduce Taxes Australia. Here are some of the most accessible tax reduction strategies that ATO allows. This rate is lower than the personal income tax rate.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. High Income earner in Australia have the most to gain. Identify and maximize all deductions you are allowedAdjust your tax offsets to the best advantage.

If you have 100000 of assessable income for the year your tax payable would be approximately 26000. The higher your tax bracket the higher the benefits are of tax savings. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

Investing in lower income earning spouses name may be better. It is important that. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

High Income Financial Planning Reduce Tax and Build Wealth. One of the best ways that you can lower your taxable income is. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Deductions Work-related expenses Donations Superannuation contributions Work-related. Delay receiving income to avoid paying tax in the current financial year. According to an analysis of countries around the world by.

If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital. Tax strategies for high income earners australia. If you are an employee.

This is a tax-effective strategy because super contributions. Leverage Home Sales Tax. Tax reduction strategies for high income earners australia.

While the US. The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax.

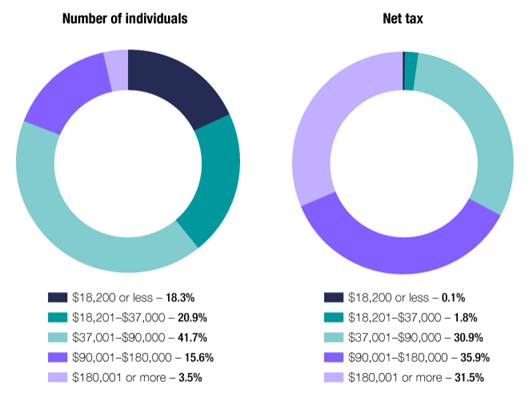

How Do Taxes Affect Income Inequality Tax Policy Center

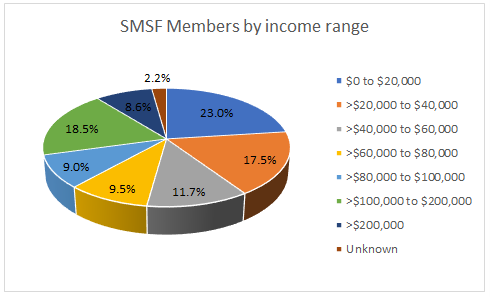

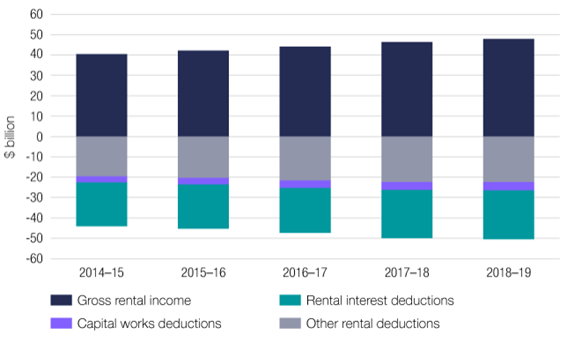

100 Aussies Five Charts On Who Earns Pays And Owns

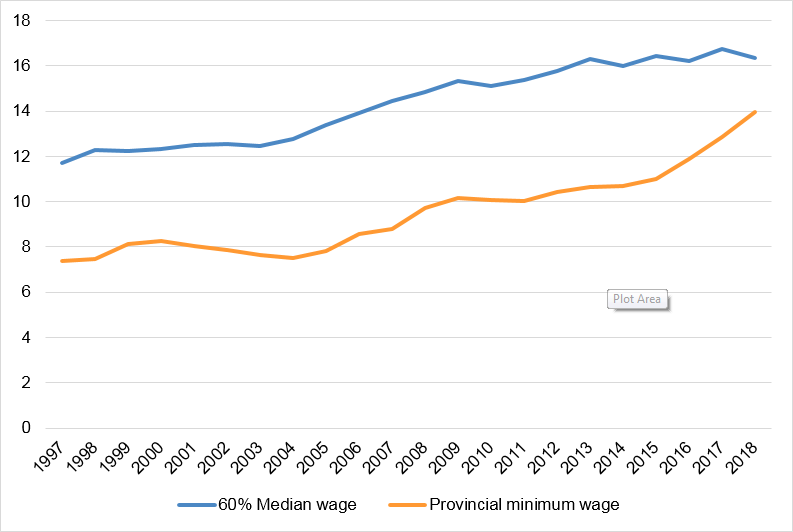

Report Of The Expert Panel On Modern Federal Labour Standards Canada Ca

People S Republic Of China In Imf Staff Country Reports Volume 2018 Issue 092 2018

People S Republic Of China In Imf Staff Country Reports Volume 2018 Issue 092 2018

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

4 Tax Breaks For High Income Households The Motley Fool

Fiscal Policy And Income Inequality In Policy Papers Volume 2014 Issue 040 2014

Committee Report No 27 Fina 42 1 House Of Commons Of Canada

Fiscal Policy And Income Inequality In Policy Papers Volume 2014 Issue 040 2014

100 Aussies Five Charts On Who Earns Pays And Owns

Fiscal Policy And Income Inequality In Policy Papers Volume 2014 Issue 040 2014

Committee Report No 27 Fina 42 1 House Of Commons Of Canada

100 Aussies Five Charts On Who Earns Pays And Owns

How Do Taxes Affect Income Inequality Tax Policy Center

Fiscal Policy And Income Inequality In Policy Papers Volume 2014 Issue 040 2014